Personal finance types, myself included, often recommend making small lifestyle changes to save more money for retirement. A prominent example is the latte effect, which holds that cutting out a daily cup of coffee can theoretically save 1,000’s of dollars (it can). This kind of advice, however, really gets under some people’s skin.

Take Annie Lowrey for example, one of my favorite economic reporters from the NY Times, now working at NY Magazine alongside another of my favorites (on the political side), Jonathan Chait. Lowrey recently had a feature on Mr. Money Mustache, but before that she published a short critique of the latte effect advice typically dished out by personal finance gurus.

Her main point was that, yeah, sure, a person can save a little bit of money on a daily latte, but that’s not really going to be what makes or breaks them financially. It is the larger expenses that matter the most. Telling people that they can simply buy less coffee to achieve an early (or even on-time) retirement is misleading and also, from a political point of view, diminishes the real financial challenges that struggling lower and middle-income families face.

And she’s right. The latte effect does work, but only at the margins. The real financial leverage is to be found elsewhere.

The Hindu Triad of Household Budgeting

The Hindu Triad, also known as the Trimurti or the Hindu Trinity, is the Hindu idea that there are three principal forms of God, namely:

- Brahma (the creator)

- Vishnu (the maintainer)

- Shiva (the destroyer)

Similarly, in the world of FG ROI personal finance, there are three principal forms of Budgeting, namely:

- Housing

- Transportation

- Food

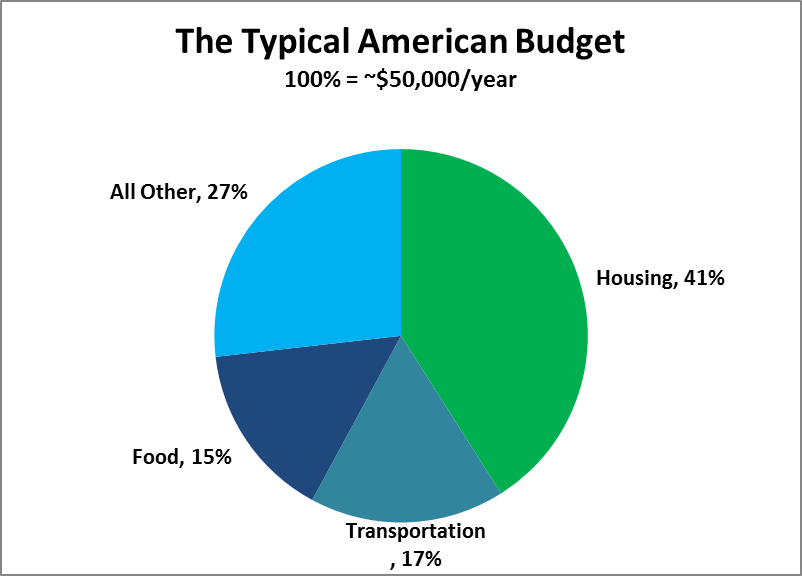

These are the three principal forms of Budgeting in my book because they account for the vast majority of a typical household’s spending:

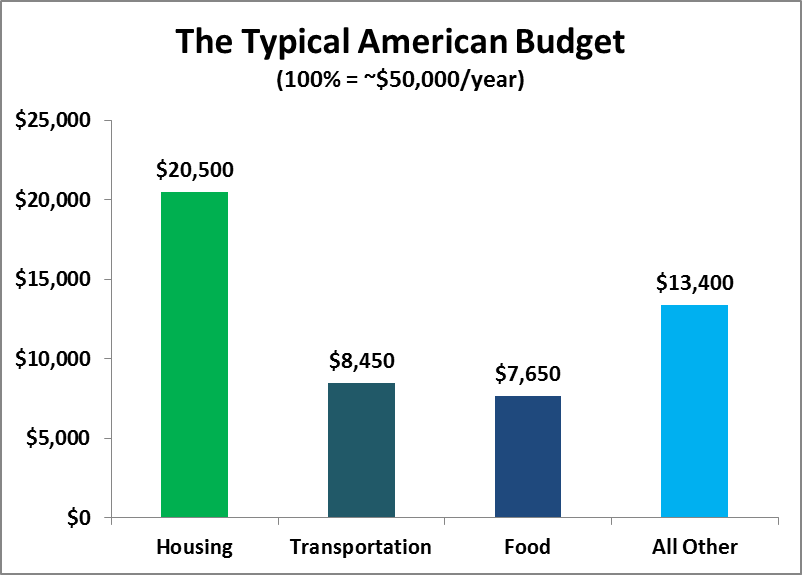

These three budget expenses have the power to create, maintain, or destroy the Average American’s net worth. Looking at it from an absolute dollar perspective shows just how important housing is in this equation:

It is important to make the distinction here that I’m looking at housing strictly as an expense. Some might consider it an investment in the case of paying down a mortgage (versus renting), but really, a home tends to be an inferior investment on average, barely keeping up with inflation over the long-run.

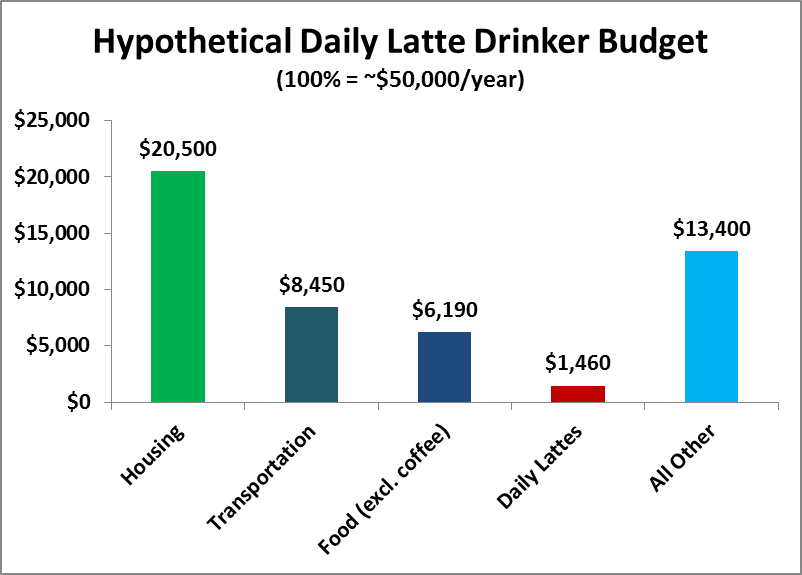

So, to get back to and really drive home the point about the latte effect, here’s how a daily $4.00 latte compares to all the other expenses:

The latte expenses are pretty small in the grand scheme of things (about 3% of total spending), but they’re still important as part of a larger spending-reduction strategy. However, for someone not saving anything at all, cutting lattes out by itself won’t be sufficient.

It would take 20 years of investing the latte savings simply to pay for a single year of retirement. Might as well just keep drinking them and rely on social security down the road. That’s not my true recommendation, but I couldn’t really blame someone in a really tight, somewhat hopeless financial situation for making that decision.

Saving is like rolling a giant snowball. If someone starts out with just a tiny blueberry-sized ball of snow, it is going to take a long time to roll a big, grass-flattening, twig-crunching snowball. It’s much easier to start with a bigger, football or basketball-sized mound.

To take the metaphor even further, if one wants to gather a basketball-sized mound of snow, it is better to start higher up in the hills where there is more accumulation and the snow is deeper than to go looking for snow down in the valley where there is just a dusting.

For personal budgets, housing expenses are like the deep snow at the top of the hill. This is the place that people can usually save the most money. Further down the hill are transportation and food. Then all the way at down in the valley are things like shoes and books.

The smart snowball roller lets gravity do the work for them, starting at the top of the hill and rolling it down to the valley, letting it pick up whatever spare change there is along the way. This is the best path for a budget.

No More Metaphors

In more concrete terms, this means first and foremost, live in a less-expensive house (1)(2) or get roommates. Allocate maybe 20-30% of the budget to housing instead of 40%, but also try to live close to work because each 10 miles of a commute cost roughly $3,700 per year in transportation expenses. Maybe work from home. And if that can’t happen, there’s always public transportation, walking, or biking. Or if driving is a must, get a smaller, used, economy car, and avoid rush hour.

Then finally, cut back on food expenses. Cook at home more, buy or make your own less-expensive alcohol, bring lunch to work, maybe garden, and yes, I’m going to say it, get rid of the daily latte! 😉

Between these three expense categories, the Hindu Triad of Household Budgets, a typical American family could theoretically save 15% of their income on housing, 10% on transportation, and 5% on food for a combined savings rate of 30%.

If a family starts young, these changes could mean retiring early at 50, which is still a long career but significantly shorter than the alternative scenario of working another 15 or more years to retire at 65, 70 or even later.

Simply focusing on housing alone could have a substantial impact on savings rates and working years. If there could only be one place to focus, this would be it, not only for the large savings possibilities but also for the automation potential.

Housing is a recurring contractual expense, which, once set at a lower level, doesn’t require any additional willpower to maintain. Compare this to having to avoid the temptation of take-out after a long day at work or with the kids…. Way easier to set it and forget it with housing than to have to turn down friends for drinks or forgo the AM latte (gasp!).

Conclusion

As a kid, I remember hearing some life prioritization advice that really stuck with me. The speaker had an empty mason jar that she wanted to fill with a few medium-sized rocks and smaller pebbles. On her first attempt to fill the jar she started with the pebbles and then tried to add the larger rocks, but they wouldn’t fit. On her second attempt, she started with the larger rocks and then poured the pebbles over the top. Everything fit.

The point of the demonstration was that the most important things in life should have the highest priority, the biggest things (family, friends, health, etc.) need to be addressed before moving on to the smaller things.

Housing, transportation, and food are the biggest items in most budgets, the Hindu Triad of Household Budgets, and, hence, represent the best opportunities to cut expenses, increase savings, and retire early. So spend well and Namaste 🙂