Intro

ROI’s are all over the internet, so instead of recreating them all the time to fit my standard 10-year model, I’m just going to summarize a few below. Don’t get me wrong, I’ll still do my own ROI’s from time to time, but by this point, I feel like I have covered a lot of ground and the remaining possibilities are either too technical or too particular to really interest me.

I’ll come back and update this page as needed when an interesting ROI catches my eye or I get a specific request, but here are a few to start out with.

Other ROI’s

- Getting lasik surgery – Lasik surgery costs about $4,500 total for both eyes and is a slightly better financial (and convenience) proposition for contact lens wearers. This Daily Finance article estimates that lasik surgery pays for itself in about 12 years, but this doesn’t factor in opportunity costs nor the intangible benefits of not having do deal with lenses all the time. The bottom line is that this is probably a neutral financial decision over 10-20 years.

- Using cloth diapers – The are a variety of cost comparisons online for cloth vs. disposable diapers. There is some variance between the savings calculations, which don’t include the extra time costs of having to wash cloth diapers (nor the environmental costs of disposable), but on average, it appears that cloth saves around 200-300 dollars per year, more so in the 2nd and 3rd year. Here are some links (1)(2)(3)(4)(5). Convinced? Do some shopping here, or lever the ROI even more by getting used diapers.

- Peeing in the shower – My friend challenged me to do this ROI, which is completely frivolous, but since we’re on the topic of diapers, why not?.. If a single toilet flush costs 2.5 cents, then peeing in the shower saves about $90 over 10 years.

- Various home energy efficiency upgrades – GreenandSave.com has a great Master ROI table. Tune-ups have a combined average annual savings of $1,100 per year, while all remodel projects save about $4,000 per year on average, and advanced system upgrades save a combined $7,300 per year but also have the highest upfront costs.

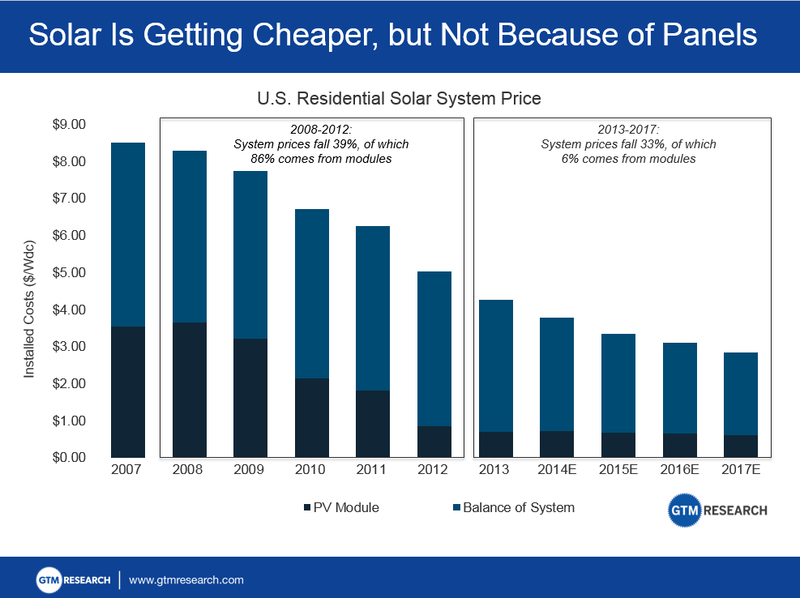

- Installing solar panels – This is an expensive and complicated decision. This couple spent over $50,000 on their solar panels before rebates and tax incentives (net was $30,000). They expect to break even in year 7, but that is with some key assumptions such as increased resale value. To customize calculations for your own situation, there is a really simple calculator here and a really complicated one here. The good news is that solar continues to get cheaper. The bad news is that subsidies and other advantages such as net metering could be repealed. As it stands now, there are 13 states where the expected return of solar panels is greater than that of the stock market.

To be continued…