Intro

I’ve been blogging for about a year now, and I’ve really enjoyed it so far. My goals starting out were to learn more about personal finance and quantify some common time and money decisions while picking up a little petty cash along the way. I’ve succeeded with the first two goals but so far haven’t accomplished the third, that is, to make some extra money.

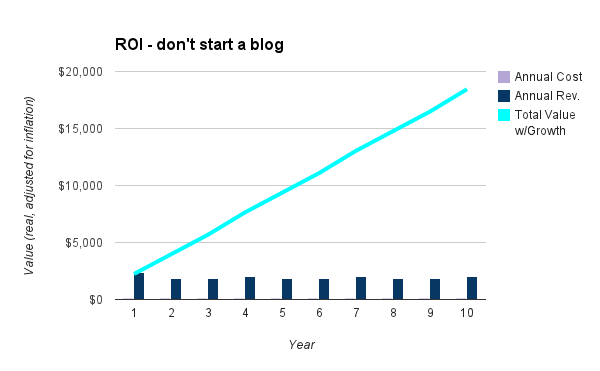

By my estimates, if I repeated this first year of blogging 10 times over, I’d probably lose about $25 per year of cold hard cash in the process. However, if I include all the time I’ve invested, my costs jump to an average of $1,850 per year. Do the math and it’s pretty obvious that blogging, or at least the direct financial impact of blogging, isn’t a winning proposition for me.

A soft focus my blogging experience and plans

There are a few things I want to note. First off, I’ve never been single-mindedly driven to make a living from this blog. I get a lot of intangible value from researching various topics and optimizing my life (and the thought of maybe helping others do the same).

My philosophy has been to use a modest salt and peppering of ads and affiliate links within what I like to believe is some decently good content. Content, specifically building out a huge reference of ROI’s and ways to save money, has been my goal, not establishing a viable business.

Therefore, I don’t really feel like I’ve failed as much as that I’ve simply learned from a personal experiment (quite a few things, actually, that will likely save me 10’s of 1,000’s of dollars in the future, but that’s the intangible value).

There are some personal finance bloggers that make a whole lot of money, such as Jay Money from Budgets Are Sexy and Michele Schroeder from Sense of Cents, but judging from the massive swell of other PF bloggers out there, I’d say that they are the exceptions rather than the norm.

For someone thinking about getting into blogging as a business, I’d recommend doing much more networking and marketing than I have done (commenting on others’ blogs, guest blogging, giveaways, social media interactions, etc.). Unless there’s a really compelling story, it seems like this is pretty important. Another piece of advice that I hear all the time is to stick with it…. most people give up too early. A loyal following takes a few years to build. Finding a less-crowded niche might also help out a bit.

Personally, I think I’m nearing the twilight phase of this blog. I anticipate sort of finishing the ROI reference book of common ways to save time and money in a few months and then shifting into a lower gear, updating less frequently, only when I feel the granddaddy blogging spirit calling me. I want to continue to produce quality content rather than beginning to write uninspired posts.

If I really did have goals of turning this into a more profitable venture, I think offering some sort of service like blog consulting or personal finance coaching could generate some good revenue, but I’m not inherently drawn to these things. I’ve got books to read, a career to grow, societal problems to solve, kids to raise, hikes to take, and a wife to love. This is more than enough to fill my cup for the time being 🙂

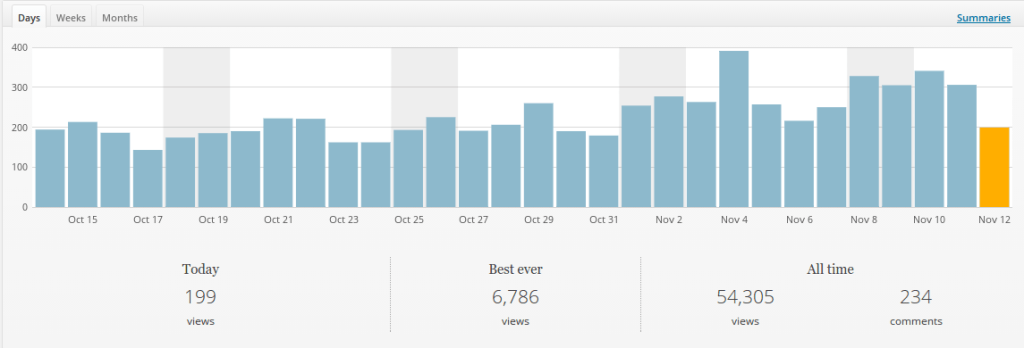

Blog stats

My blog gets about 250 views per day with a little over 30% of them coming from search engines:

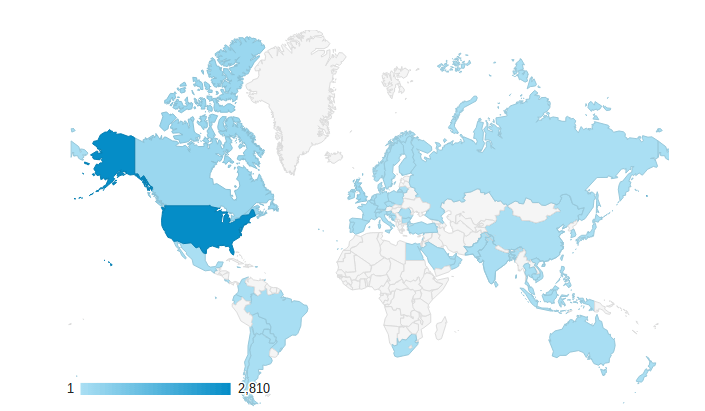

I get visitors from all over the world (see below) and have been featured in some major online publications a few times, such as Business Insider and Yahoo Finance. In fact, my best day of traffic was the day that Business Insider and Yahoo Finance picked up my article, “When can you pretire?”

I average a little over $9.00 per month in revenue, with about 30% coming from Amazon.com Affiliate links and the rest from Google ads. Subtract expenses of about $11.50 per month (annual hosting fees and $70.00 one-time site template expense), and it is easy to see how I’m just barely losing money. However, add in the optimistic 3 hours of time I spend per post at $10.00 per hour and profit turns south very quickly.

The good about these numbers is that, excluding time, I’m right on the cusp of break-even. One or two more high-ranking posts could actually bump me into the green. Either way, what it really boils down to is a labor of love. I’m actually excited to write new posts most of the time. So it’s all good with me.

Because I’m Flannel Guy ROI, this post wouldn’t be complete without the obligatory summary stats so here they are, the ROI of NOT starting a personal finance blog:

Conclusion

Even journalists are having a hard time making good money these days, which means it’s probably even harder for bloggers. I’ve loved the blogging experience so far, but it hasn’t been because of the extra income. Maybe I’m the anomaly, but I don’t think that’s the case.

If you’re thinking about starting a blog, make sure it is for the right reasons, and then if you’re still thinking about it, you should really think about using this Bluehost affiliate link I’ve got to get started 😉