How long would it take you to become a millionaire if you were maxing out your tax-advantaged retirement accounts and nothing else? What about if both you and your spouse were doing that together? And when would you be able to retire?

Maxing out retirement accounts is not easy by any means, but it is a really nice concrete goal to shoot for.

The Numbers

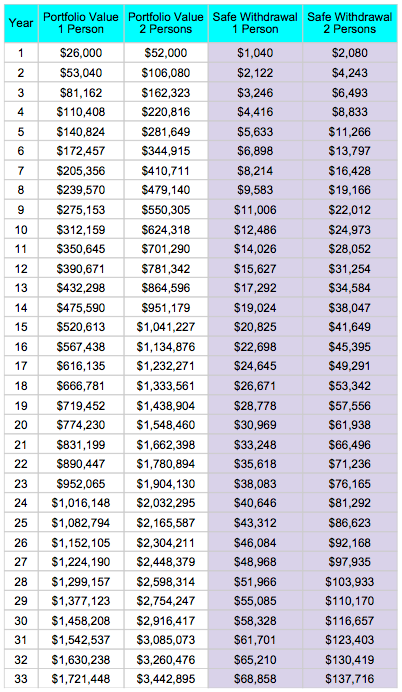

Assuming that you save $17,500 per year in a 401k and $5,500 in an IRA, plus a $3,000 employer match on the 401k, your total annual savings would be $26,000. In a two-person household, it would be double that, or $52,000. Here is how long it would take for you to reach millionaire status (in today’s dollars):

- 1 Person: 23.7 years

- 2 People: 14.5 years

And just as an FYI, in case you don’t have as generous of a 401k employer match, it only saves about 1-2 years, depending on the scenario.

So How Long Would It Take You to Retire?

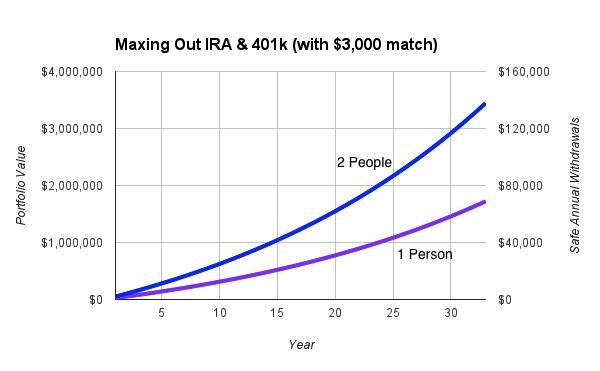

If you were comfortable with $40,000 per year passive retirement income, you would be set with a million dollars based on a 4% withdrawal rate, which could theoretically be maintained indefinitely. But what if you had other spending needs? This chart and table should help:

The left axis is the value of your portfolio over time and the right axis is the annual safe withdrawal amounts. The blue line is for one person and the purple line is for two people. Here are the actual numbers:

Again, I’m keeping this in real dollars by using a 4% long-term growth rate on the portfolio. This means that a million dollars will have the same purchasing power in 30 years as it does today.

Commentary

There are all sorts of finer considerations for this kind of calculation, but I’m just going for the 80% quick and dirty overview. For one thing, the stock market might not grow as quick as it has in the past, or it might grow faster. Then you have taxes to consider, which I won’t even touch. And then there is the problem of not being able to get the money until a certain age, but there are work-arounds for this. Mad Fientist does a good job with that kind of stuff, if you’re interested.

So, as mentioned above, I’m writing about this scenario because it is a really nice measurable goal. Not everyone is in a position to be able to do this, but for those that are fortunate enough to have the willpower and earning power, now you know.

And if you’re not in a position to do this, contributing to your 401k enough to get the full employer match is a really nice goal to start out with. It is essentially free money for the taking.

If you want to see someone who has made retirement accounts work in their favor, check out J. Money’s net worth tracker from Budgets are Sexy. By mainly focusing on maxing out retirement accounts his net worth is almost 10x higher than what it was when he started tracking it 6 years ago at $50,000.

Like J says, simple, but not easy. Happy saving.

==================

Addendum

TP makes a great point about investing in Roth IRA vs. a traditional IRA below mostly due to higher income thresholds. I don’t mean to encourage investment in one type over the other; saving is the main point.

Also, an implicit assumption that I didn’t highlight above is that the IRA and 401k contributions are pegged to inflation. Obviously this isn’t formally the case, but I hope it is reasonable to assume that higher limits will be set at least every decade to keep up with or outpace inflation.