A lot of personal finance bloggers advocate an extremely short path to early retirement, something like 7-10 years through extreme savings. I am not against this kind of saving, and, frankly, wish I was more up to the task myself. However, that kind of saving is not easy and not for everyone.

A lot of people probably (right or wrong) feel like saving 70%+ of their income is too much to ask… too big of a sacrifice. My wife and I tend to have a foot in both camps. On one hand, getting to early retirement as fast as possible is definitely worth some major sacrifices for us now, but on the other hand, what would happen if one of us got in a car accident and/or died? Wouldn’t we want some really cool experiences and memories under our belt as a hedge against the worst case scenario. I believe this theory is called consumption-smoothing in economics.

Of course, wanting to spend a little more money now to hedge against the possibility of a less-than-perfect future is not a license to buy $60,000 luxury cars or make it rain at the club, but it is a nudge for us to spend money on things that truly bring happiness now, namely experiences, people, and pro-social family and friend spending.

With more moderate, but still above-average, savings rates in mind, I introduce to you the 18-year rule. I discovered this in one of my excel spreadsheets, and it is basically a derivative of the savings rate versus years to retirement chart. However, 18-years and a 50/50 split between saving and spending are nice clean numbers and provide a more middle-of-the-road path for certain early retirement and financial independence enthusiasts.

The idea is simple enough:

If your annual spending is relatively constant and you save the equivalent of your annual spending for 18 years in a row, you can retire. Period.

How to put this another way??? Save at least what you spend and you can retire in 18 years, assuming you don’t drastically increase your spending over that same timeframe.

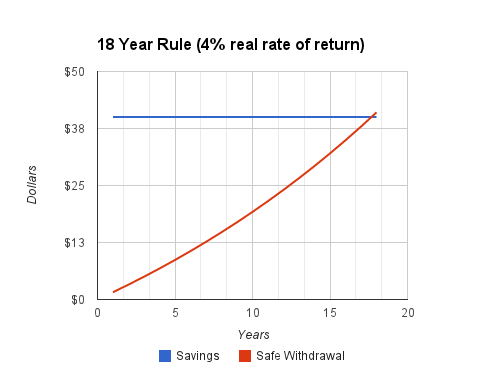

The way it works is that you invest the equivalent of your annual spending (necessarily 50% of your income) in the stock market each year. That money grows at a conservative, inflation-adjusted rate of 4% per year (based on historical stock market returns). Assuming you can safely withdraw 4% each year (more conservative folks urge 3%), that means you will have enough passive income to live off of after 18 years. Here is how the chart looks for a couple that spends and saves $40,000 per year:

Another spin on this, is that if you save the same amount for 18 years in a row, you can safely withdraw that amount over time. So if you maxed out your IRA and 401k every year for 18 years at $23,000, you could safely withdraw that much every year going forward, even if it wasn’t enough for you to completely retire on.

There are a lot of ways for haters to hate on this kind of reasoning, and I think it is fair enough from a pessimistic perspective. For one thing, the 4% real rate of return, while on the cautious side, might not materialize. You might invest at the top of a bubble only to make back your principal investment 18-years later. This is a possibility, albeit a small one. Another possibility is that the stock market growth slows for a variety of reasons I don’t want to get into right now, such as rising inequality and slower productivity-enhancing advances in the economy at large.

On the flip side, you might invest a lot more of your money during a downturn and end up with more than a 4% real rate of return. It is impossible to say what will happen, but based on average long-term historical stock market returns, you would be able to retire after 18 years.

The other thing to talk about is the potential for lower spending in retirement. If you are making mortgage payments during your 18 years of savings, eventually you will not have to make those payments anymore, resulting in a surplus of retirement funds due to lower spending. There is also the issue of kids. If you can save your annual spending with kids in the house, the idea is that someday they will move out and your spending will be less, again resulting in a surplus of retirement savings (although college may complicate matters depending on your philosophy there).

And then finally, there is the issue of retiring at a relatively young age. If you started this habit at age 20, you might be able to retire by age 38. But the odds are that a 38-year old still has more juice in them and will want to explore different, more interesting ways of earning income, perhaps just a small amount, after they have their expenses covered through passive income. This would give you an extra buffer and flexibility by allowing retirement funds to grow more before you start withdrawing.

The general point is that saving your annual spending for 18 years can most definitely leave you with enough passive income to retire in an okay market. If it doesn’t work out that way, you are still way ahead of the game. Start saving the equivalent of your annual spending today, and get on track to retire in 18 years!