A strong savings rate is the cornerstone of early retirement and financial independence. A low savings rate means you’ll have to work longer to retire, while a high savings rate will allow you to retire earlier.

The idea of saving, specifically, spending less money than you earn and, say, stuffing the extra money under your mattress, has been around forever. The basic savings rate formula is savings divided by income, where savings is income minus spending. So if I make $40,000 per year and spend $30,000, my savings rate would be 25%, or $10,000 (savings) divided by $40,000 (income).

As I said, this concept has been around forever, and I don’t intend to take any credit for linking high savings rates with early retirement and financial independence. For me, that credit goes to Mr. Money Mustache, a regular dude that retired with his wife at age 30 after working less than 10 years, earning about 20% over the median U.S. household salary (each), and saving 66% of their take-home pay.

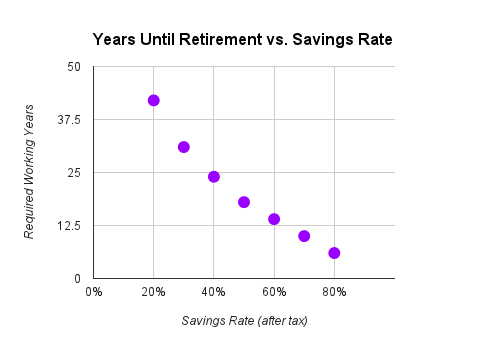

You might recognize the chart below from my introductory post on early retirement and financial independence.

This chart illustrates the relationship between savings rate and years of work required to retire, based on certain assumptions like 4% inflation-adjusted investment growth. I encourage you to read my post and/or check out my inspiration, Mr. Money Mustache’s Shockingly Simple Math Behind Early Retirement if you’re interested in learning more.

My goal here is to explain how the savings rate and early retirement dynamic works in a simple, logical way.

I first came across this alternative, easy to understand explanation at Jim Collins’ blog (I believe), but I can’t find the link for the life of me. Luckily J.D. Roth also invoked this explanation recently in his guest post for MMM – How I Learned to Stop Worrying and Love Mustachianism.

Anyway, the point is: this isn’t an original idea by any stretch of the imagination, but I’m going to present it again here with a few more charts, because, hey, this is important stuff and a little repetition never killed anybody.

The savings rate – retirement connection

The idea is simple and intuitive enough: save more, retire earlier; save less, retire later.

Think about it this way. Let’s say you saved 50% of a $40,000 salary for one year. At the end of that first year, you will have spent $20,000 and saved another $20,000. So now you have one year of future spending in the bank (or mattress). This is equivalent to one year of retirement. If you wanted to take an entire year off from work, you would have the money to do that.

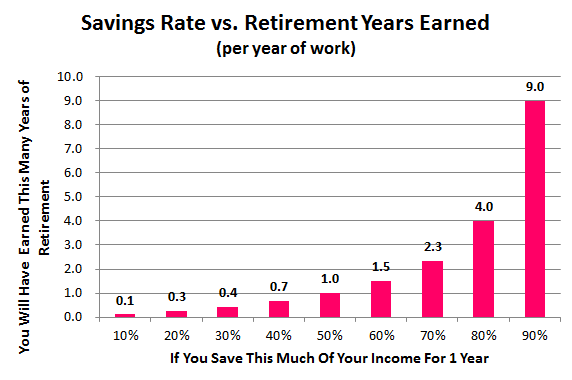

Here is a chart that illustrates said relationship:

Using the 50% savings rate example again, the way to read this chart is that for every year you save 50% of your income, you will have earned one year of retirement. At a 60% savings rate, that number jumps to 1.5, and so on. It becomes pretty obvious after looking at this chart for a second that high savings rates earn you dramatically more retirement time per year of work.

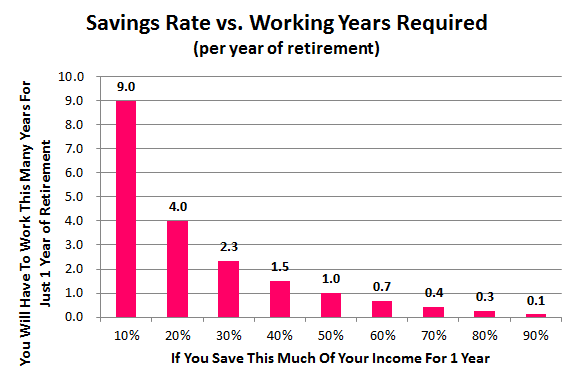

Now let’s look at it the opposite way. At various savings rates, how many years will you have to work to save enough for one year of retirement? It is exactly the opposite of the chart above:

So looking at the numbers this way, you can see that a 10% savings rate means you need to work nine years just to have enough for one year of retirement, whereas saving 40% means you will earn a year of retirement for every year and a half of work.

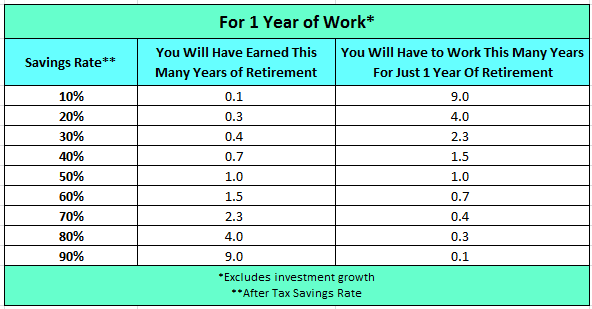

And here is the data for both charts:

Those are the basics of how savings rates impact the number of years you will have to work until retirement. I’ve oversimplified a bit, most notably by assuming that your savings doesn’t generate investment growth. The purple dotted chart above, however, does assume growth, but all the others don’t, mostly because it is easier to understand the pure logic this way.

Investment growth doesn’t really have much impact on people with high savings rates because there isn’t much time for money to grow in the few years that they are building nest eggs for retirement, but people on the lower end of the spectrum shouldn’t stress too much either.

Growth will probably shorten your years to retirement a bit more than what the data table shows above. Just check out the purple chart up top for a more accurate estimate. Additionally, if you wait long enough, you might have some other sources of passive income like social security or pensions. The other major assumption is that your absolute income and spending levels stay relatively consistent over the years (keeping up with inflation).

Putting it all together

Hopefully, it clicks for you the way it did for me when I first came across this information. My wife and I are working our way up the savings rate ladder, achieving about 40% in 2013 and hopefully more in years to come as we optimize housing, transportation, and other costs even further. We’ve climbed to 40% from less than 10% a few years ago through a combination of salary increases and spending reductions.

I focus primarily on the spending side of the equation because I think there are a lot more opportunities for improvement there. Plus, I’m a big believer in the idea that “less is more,” especially when it comes to early retirement and financial independence. I don’t hate my job, but I’m not interested in being one of these guys for the remainder of my days:

I’ve got bigger plans for life including spending more time with the people I love, giving back to my community, being an involved dad, and living closer to nature.

These goals align well with some of my top values and make the small marginal spending sacrifices required in pursuit of higher savings (and earlier retirement) feel much more like what they really are: small and marginal. So that’s my perspective.

If you’ve got a similar outlook, hopefully, these numbers are a helpful reminder and/or introduction to the importance of a high savings rate.