Welcome to my first READER REQUEST. I love ideas for new posts, especially from readers. This is my inaugural reader request, and I hope to do many more going forward. A big thanks for the inspiration…

In this ROI analysis, I’m going to take a quick look at whether or not a smart thermostat such as the Nest Learning Thermostat can save you money.

What Are Smart Thermostats?

For those that don’t know, smart thermostats like Nest try to save you money by reducing your heating and cooling costs. They learn your daily schedule and turn the heat down when you aren’t in the house, and, on the flip side, they have everything all nice and toasty when you get back from work (vice versa with cooling in the summer too). Additionally, you can control the thermostat remotely from your smartphone (everything is getting smart these days). So say you forgot to turn the heat down when you left for vacation. No problem, just adjust it during your layover.

Smart thermostats are part of a broader category of stuff called the Internet of Things, which basically just means that you have more and more devices talking to and coordinating with each other over the internet. Another “Internet of Things” gadget is the Fitbit activity monitor bracelet that measures your steps, sleep, and other activity. The name might be sort of lame and the industry / movement might still be in its infancy, but the Internet of Things seems like it will have a major impact on our lives in the future.

And for budget geeks like me, that future is potentially now. Enter the Nest Thermostat. According to Nest’s sexy little website (former Apple guys or something… go figure [as noted in comments below, Nest is owned by google now even though it was started by former Apple employees), heating and cooling costs account for roughly 50% of a household’s utility expenses.

The Numbers

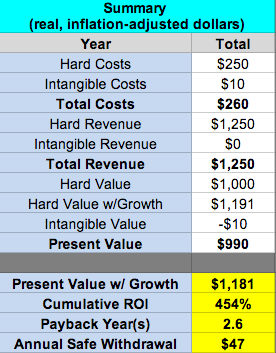

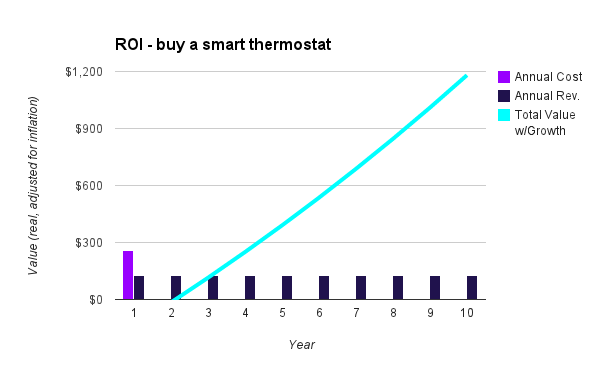

This is how much you would save on energy costs by switching to a smart thermostat. I got my numbers from Nest.com. More on that in a second.

Investing in a smart thermostat is worth about $1,200 over 10 years for the average U.S. household in the average U.S. climate. The investment doesn’t pay for itself until halfway through the second year because the Nest Thermostat is pretty expensive at $250 per unit. This means that the nest probably is a shakier investment if you rent or aren’t sure where you’ll be living in the next few years, but then again, you might be able to take it with you or, in the case of homeowners, it might actually be a selling point (as noted in comments below).

I’ll go into the methodology below, but the important thing to note here is that these numbers assume you aren’t already using an older-generation programmable thermostat.

This example assumes you mostly keep the heat or AC at a constant level all day, even when people aren’t in the house. We use an older programmable thermostat at my house already, so the savings would probably be a lot smaller. However, apparently we are the exception, because according to Nest.com, 89% of households with programmable thermostats don’t actually program them.

Another thing to consider is that some heating and cooling systems such as heat pumps, don’t save as much money with the Nest Thermostat because it takes more energy to bring the temperature back up to normal than to have never let it drop in the first place. I also think this could also be an issue with homes that rely heavily on thermal mass to regulate temperature, but from what I have read, Nest software can handle this kind of thing.

Long story short, for the average home that doesn’t already use a programmable thermostat, a smart thermostat can probably save you a nice chunk of money.

In addition to the Nest Thermostat, there are two other smart thermostats that also get mentioned a lot… the Honeywell Smart Thermostat, and the Ecobee Smart Thermostat. Apparently they operate on different algorithms which can sometimes save more money, but if you are looking to keep things simple, Nest seems like the best bet (think Apple).

Methodology

I’ll come clean immediately and admit to using Nest.com’s energy savings calculator. The first thing I did was to determine what cities have the most representative climate of the U.S. From this list of 100 city climates, it turns out that Baltimore, Maryland is the most typical (minimum cumulative deviation from indexed variable averages). Close behind were Wilmington, Delaware, Philadelphia, Pennsylvania, and Indianapolis, Indiana.

Then I figured out what the average square foot size of a U.S. house is these days. I made an educated guess of 1,500 square feet based on information from the National Resources Defense Council. Inputting these two variables and assuming the house has central AC, Nest’s calculator said I would save between $60 and $250 every year, or about an average of $155. Because I’m a little skeptical of Nest trying to sell me, I multiplied by 80% to be more conservative, which gave me a final average annual savings of $125.

And that’s the basic gist of it. If you don’t already use a programmable thermostat, get after it!

Assumptions

- Smart thermostat costs $250 – Amazon

- Average U.S. climate is Baltimore – 100 select cities data

- Average home is about 1,500 square feet – NRDC

- Takes about 1 hour to install Nest thermostat at $10.00 per hour – Amazon reviews

- You don’t already use a programmable thermostat

- A smart thermostat saves about $125 per year in energy costs