Here’s the dirty little secret you won’t hear too often in the early retirement community: income matters, A LOT. A typical handling of the income conundrum goes something like this: “Yeah, it can be hard to retire early / save a lot with lower incomes, but it is still possible if you are determined.” The sad reality that this attitude conceals is that, while it still may be *possible*, retiring early with a low-to-average income requires significantly more sacrifices.

Specifically, the average American household earning $50k per year probably won’t be able to retire in less than 30 years, even with a budget similar to Mr. Money Mustache, unless they are willing to give up some other basic necessities, which is asking a lot and living a life out somewhat out of balance in my humble opinion.

Part of the reason this harsh reality doesn’t really get highlighted too often is that it doesn’t sell; it doesn’t bring in page views. I wish, however, that it would get discussed more frequently because there is an unsettling amount of victim-blaming in certain personal finance corners of the internet. True, sometimes there are ways out of tough financial situations, but not acknowledging how much more difficult it can be for someone like Jannette Navarro, a working single mother, to escape the cycle of poverty (much less, retire early) does a true disservice to the struggles of average and low-income Americans.

The common thinking about people with low savings rates, even at lower end of the income spectrum, is that they should still be able to find some fat to trim in their budgets, which could theoretically lead them to financial independence. The truth of the matter, however, is that a basic bare-bones budget is still really expensive, even without the supposed frilly indulgences like daily lattes and weekly hair salon trips (an unfortunate racist welfare queen trope).

The Numbers

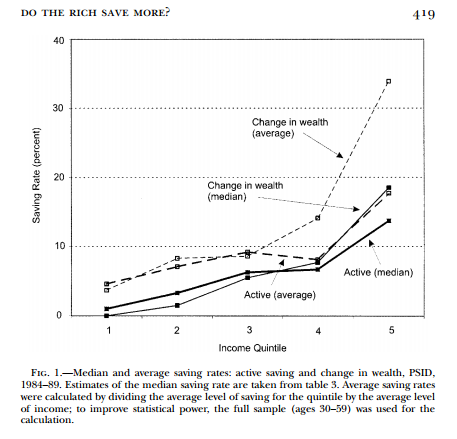

1. Not surprisingly, rich households save a larger percentage of their incomes.

Take a look at the “Active (median)” line on the bottom right. This is the active median savings rate (doesn’t account for passive increases in wealth). It shows that the richest 20% of households save about 15% of their incomes, while the poorest 40% barely save anything.

Is it because the poor are lazy and overindulgent in luxury expenses like lattes, or is something else going on? Something else, I would argue…

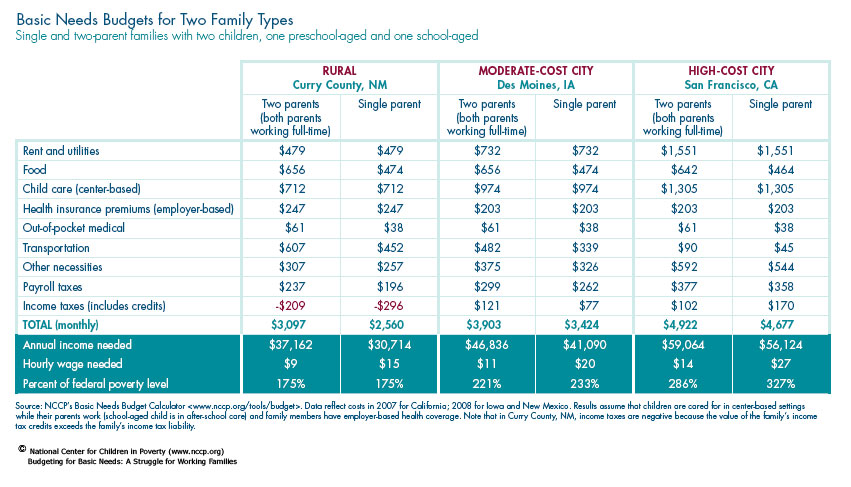

2. A basic needs budget is actually pretty expensive.

This table shows that, on average, a basic needs budget is about 200% higher than the federal poverty line. This isn’t surprising, since the methodology for calculating the federal poverty line is completely outdated and doesn’t account for things like transportation or medical expenses. In fact, it is calculated simply by multiplying the “subsistence food budget” by 3.

So looking at the specific numbers above, living in a single-adult, the two-child household in a moderate-cost city requires a little over $40,000 per year to make ends meet(2009 dollars).

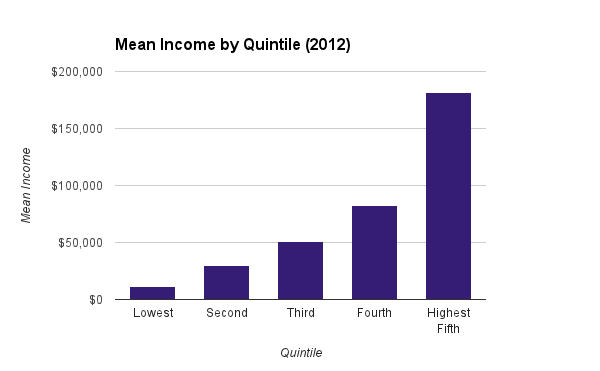

3. The average American household has about 2.5 people in it and makes about $50,000 per year (2013 dollars).

Remember the savings rates by income quintile chart above? Here are how those household income quintiles looked in 2012:

By definition, overall median income is going to be pretty close to the mean of the third household income quintile, and it is. So roughly 50% of U.S. households make more than $50,000 and roughly 50% make less.

4. The average 2.5-person household can realistically only save about $14,000 per year (28% savings rate on $50k income).

The average federal poverty thresholds for 2 and 3 person households is about $18,000. And since we’ve established that a bare-bones budget is about 200% of the federal poverty line, this means that the average 2.5-person household probably needs to spend about $36,000 a year strictly on necessities. So on a $50,000 income, that leaves $14,000 left-over for savings (before taxes).

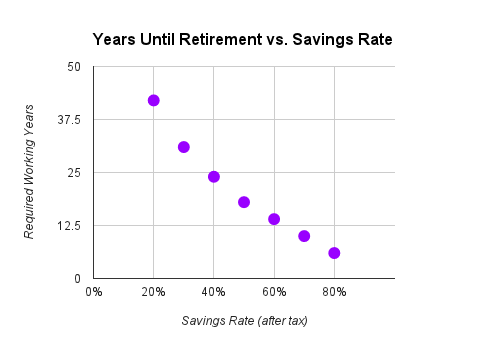

5. A 28% savings rate requires roughly 33 years of work to reach financial independence.

Remember this chart from my post on financial independence?

The chart shows, it will take the average American household, living on a bare-bones budget, about 33 years to save enough money to become financially independent. Not so easy, right? And it takes even more time for the 49% of households earning less than $50k.

A Mr. Money Mustache Reality Check and Comparison

Okay, I can imagine someone being skeptical of the bare-bones budget figure, so I wanted to run a reality check against Mr. Money Mustache’s own spending numbers. During his wealth accumulation phase, he and his wife averaged about $100,000 in combined annual income (twice the U.S. average) and $36,000 in annual spending for a rough 64% savings rate that allowed them to retire in 10 years. Not bad… quite impressive actually.

But notice the connection in annual spending between the MMM 2-person household and the bare-bones budget for a 2.5-person household. They are EXACTLY THE SAME. MMM is the first to admit that he still views their lifestyle as pretty luxurious (organic groceries, beer, and wine, nice house, etc.), and that jives perfectly with the fact that they were a 2-person household living on what I’ve calculated to be a 2.5-person bare-bones budget. They were living a little above their means (but not much)

The funny thing is that most people other than frugal personal finance nerds look at the MMM lifestyle as a huge sacrifice (no driving, even in crappy weather, very few restaurants, no international travel, limited travel in general, no cable, very little shopping, lots of DIY projects, skimping on heat and A/C, etc.). In other words, most people would agree that $36,000 per year is a very reasonable bare-bones budget for a 2-person household, even more so for a 2.5-member household.

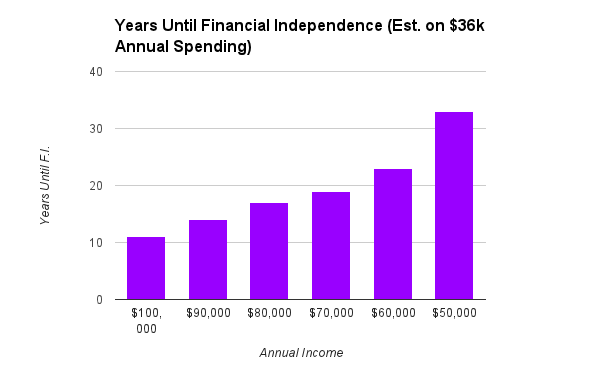

So with a $36,000 MMM-style household budget in mind. Here is how long it would take to reach financial independence given different levels of income:

In other words, while the MMM household was able to retire in about 10 years because of their high salary (and frugal lifestyle), the typical U.S. household living the same frugal lifestyle would be required to work roughly 20 additional years simply to accomplish the same thing.

Concluding Thoughts

I don’t mean to discourage anyone in the bottom half of the income spectrum from saving money. Achieving financial independence in 33 years is still better than not achieving it at all, and is also better than achieving it in 40 or 50 years. But this message is radically different from the get rich (pretty) quick promises that are normally discussed in the early retirement blogging community.

This is an important message to get across, because I have talked with low-income earners that are turned-off by the unrealistic advice they see on the internet (“Save a minimum of 50% of income!”) . I’m guilty of this too. I generally emphasize ways to cut costs rather than grow income, but I don’t mean to hide from the fact that this advice isn’t appropriate, nor realistic, for a large portion of the population.

There are some early retirement hall-of-famers, such as Jacob from Early Retirement Extreme who lived on $7,000 a year, that show how financial independence can actually be accomplished with much less. But I think most would reject his lifestyle as too radical. The more plausible path for a household with a low-to-average income is to look for ways to earn more.

In the future, I hope to write on the subject of bringing in more money. In the meantime, though, Jay Money has a great Side Hustle Series at Budgets Are Sexy, and Mr. Money Mustache also has two posts dedicated to ways to bring in more than $50,000 without a degree.

So, in closing, saving money and achieving early retirement is much easier for high-income earners. The realistic best case scenario for roughly half of Americans is to run on a bare-bones budget and still not reach financial independence for 30+ years.

Different situations call for different advice and understanding. Let’s not forget nor diminish the challenges of making ends meet for less-fortunate segments of the population.