Great news for the FG ROI clan this week… my brother and his wife had their first baby! Big ups to the proud new parents!! 😉

So their new bundle of joy got me thinking about what kind of life I want to have when I have young one/s running around. I would like to be able to retire by the time my kids start grade school so that I can be an attentive and involved parent, but quitting work in 6 or 7 years is basically out of the question given our current trajectory (more on the math of early retirement here).

However, we should have a decent-sized nest egg by that point, and a second-best option would be to transition to a part-time career where it would be much easier to balance work and family life. The pay would be lower, but it would hopefully still be enough to cover our living expenses. It would also mean slowing down or completely stopping retirement contributions, but on the bright side, we wouldn’t have to touch our existing savings, which would continue to grow in the background.

To be clear, the obvious trade-off of retirement would be a longer waiting period until full retirement, but we’ll get to that below.

A Formal Definition

I’ve heard others refer to this one-foot-in, one-foot-out kind of arrangement as pretirement. My formal definition is as follows:

Pretirement (noun) \pri-ˈtī(-ə)r-mənt\ : a stepping-stone compromise between full-time work and full-time retirement, where retirement savings have been suspended but withdrawals have not yet begun

The Numbers

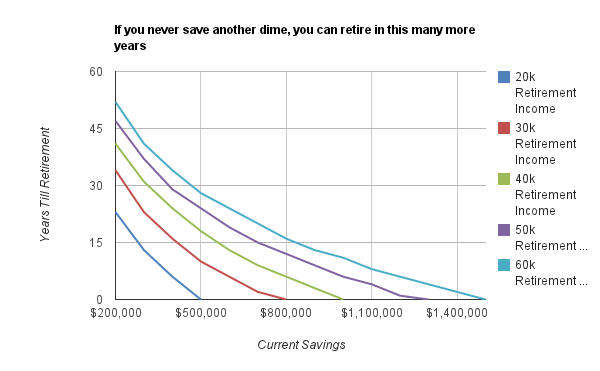

So when are you eligible to pretire? It all depends on your current savings and desired retirement income:

To use the chart above, find your current savings along the bottom axis and trace directly up to the colored line that represents how much income you want each year in retirement. Now trace over to the left-hand axis. Where are you at… 15 years… 20 years?

This number represents how long you would have to wait to fully retire if you never saved another dime. And by fully retire, I mean quit work completely and live off your passive investment income without ever having to touch your principal investment. In other words, this is the anticipated length of your pretirement.

The way I used this was to guess what my total savings would look like in 6-10 years (when my kids are still relatively young). Then I figured out how long I would have to work part-time if I wanted to pretire during that time.

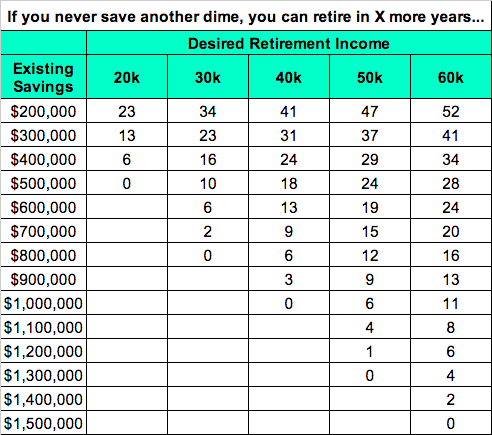

Here is the table version as well:

Same thing… find your total existing savings and then trace over to your desired retirement income column. Add this number to your age and you can see how long your pretirement period would probably have to last.

There are a few caveats to this information. First, I’m assuming a 4% safe withdrawal rate and a 4% real rate of return. The rate of return assumption might be a little conservative for long-term, inflation-adjusted growth on a stock portfolio while the 4% safe withdrawal rate might be a little aggressive, depending on whom you ask.

The idea behind the 4% withdrawal rate is that you could theoretically maintain it forever because investment growth will cover or outpace withdrawals… your $1,000,000 nest egg never really gets any smaller even though it keeps throwing off $40,000 in passive income per year.

An older retiree could probably sustain a much higher withdrawal rate due to shorter life expectancy because they wouldn’t need their savings to last as long. Check out this link for more on successful allocation, withdrawal rate, and retirement period combinations.

What I’m Cautious About

Pretirement does come with some obvious risks and downsides. Some of the main risks include slower investment growth than predicted (the stock market does bad) and higher-income needs later in life (expensive college, unexpected major life event, increased travel to visit kids/grandkids, etc.). Depending on timing, there is also the possibility that you end up putting your career on the back burner during your peak earning years, a time when you could really accumulate savings.

You’re also sort of closing the door a bit on the upside chance of being really wealthy, having the kind of money that could maybe double or triple your lifestyle or that you could pass on to your kids, if you’re into that kind of thing. There is also a little less flexibility in this arrangement versus full retirement, but opting for contract work over part-time work could be a possible solution.

On the whole, the downside risks of pretirement basically amount to a smaller margin of error for retirement planning.

What I Like About the Idea

Ever heard the phrase, “it’s a marathon, not a sprint”? It’s a little like that. Or it’s a little like “everything in moderation.”

In real terms, keeping one foot in the working world helps keep your skillset sharp in case you ever need to go back to work full-time. Also, old age is supposed to be pretty grand, but having a part-time gig even when you have enough money to fully retire seems like a nice way to keep your mind sharp and stay engaged. Why delay what will eventually be the new normal when you retire anyway?

Additionally, there is a chance that maybe you will find more success and/or a clearer purpose in your pretirement working career. I’m thinking of people who use pretirement as an excuse to start their own business and end up making much more than they did in the past. This scenario actually seems pretty likely given the reduced stress, increased health, just generally improved well-being that comes from working less. There is evidence that disposition drives success more than the other way around, so it isn’t crazy to think pretirement would earn you more money and fulfillment, especially on a per hour basis.

Another thing, working 40+ hours a week can really wreck your body, even if you’re an avid exerciser during off-hours. More balance and moderation seems like a good thing in both the desk jockey and manual laborer world. Take care of that body. And also save money on some transportation expenses with extra time for cheaper modes and fewer office commutes.

And finally, depending on how you time it, you might not need to do any fancy tricks with your tax-advantaged retirement accounts to get the money out early. Just wait till normal age like most folks and don’t worry about blowing up your tax brackets either.

Conclusion

For my situation, I think the upside potential outweighs the downside risks. A lot of people say losing their job was the best thing that ever happened to them because it forced them to pursue a new and ultimately more rewarding path. I’m hoping for a similar kind of experience with pretirement (minus the pressure to find more work) and of course some more quality time with my family.

So that is the current plan, at least while our kids are young, aren’t embarrassed by us, and still live in the house. Personally, I think it will be pretty hard to take my foot off the gas when I’m close to the finish line, but unfortunately, I’m not in a position to make that choice just yet 🙂

What do you think? Would you consider pretirement as a stepping stone or do you prefer a speedier route to full-time retirement?