How much money could you save by working from home, or to put it differently, how much of a pay cut would you be willing to take to work from home? Answer: $106,000 over 10 years, over 2 times the average American salary. Unfortunately, quality work-from-home opportunities are not always easy to come by.

If you are lucky enough to work for a company with an established telecommuting policy and you don’t already work from home, you may want to reconsider. Working from home isn’t for everyone, but for the early retirement / financial independence enthusiast, it can be a very powerful lever to increase your savings. There are also other fringe benefits such as more comfortable work attire, possible tax deductions, lower clothing expenses, better time utilization, geographical arbitrage, etc.

In this example, I assume U.S. averages for commute times and distances, and more importantly, I assume that you would not need a car if you were working from home and that you would use a bicycle instead for groceries and such. You can download and modify the spreadsheet if you want to change any of the assumptions. Okay, here are the exceptional stats for working from home and getting rid of your car:

- 10-Year NPV: $106,106

- 10-Year ROI: 1,768%

- 10-Year Payback: 0.1 years

The first thing you notice is that most of the savings come from not driving to work. In this example you save on both the intangible time costs and hard costs of car ownership. I don’t count any of the intangible time costs for using a bike for groceries and other errands because this is free exercise. In other examples, I have counted bike time at $5.00 per hour but that was because it was almost too much exercise. In this example, we are assuming 2 hours a week, which is just the right amount or maybe even not enough exercise (some people might actually pay for this at a gym).

For readers who are uninterested or a little uncomfortable with putting a monetary value on time and other intangibles, you can sneak a peek at the hard value with growth stat. For this example, not including the time savings, we are looking at about $86,000 in direct or hard cost savings. Not too shabby. If you don’t want to include growth nor intangibles, we are talking about $70,000, which is still pretty amazing.

This investment obviously pays for itself pretty quickly because you don’t have to buy much more than a bike to get started. In real terms, the value might actually be higher for you if you already own a car that you can sell and invest the revenue immediately, versus the way I have modeled it, spread equally across all 10 years.

On a less technical level, I think this is pretty cool. I don’t particularly like the office work environment, and I think I could be a lot more productive at my job and in my personal life working from home. It has always appealed to me; I just worry that I wouldn’t be able to earn the same kind of salary with a telecommuting job. However, I might put that theory to the test once I move into a more permanent living situation.

Efficiency is one of the main reasons that telecommuting jobs appeal to me so much. My experience is that people waste a lot of time when they have to sit for 8 hours straight in front of a computer. The brain simply can’t keep operating at such high-intensity without breaks, but what breaks are available to you in an office? Snacks, lunch, a quick walk, surfing the internet? Wouldn’t you save a lot of time if you could take the dog on a walk, vacuum the living room, or run a quick errand instead of surfing the internet or Facebook? Not to mention, your work quality might actually improve because you are able to fully engage and are not as mentally fatigued.

Thinking about work from home jobs reminds me of the whiskey streams on big rock candy mountain because they seem too good to be true. Even though it would probably save some companies a lot of money, I think most companies are reluctant to implement work-from-home policies because it can be quite a challenge to measure employee performance in a fair and objective way, and they might not trust their employees (rightly so, perhaps). Attendance and long hours are used as a proxy for performance in many office environments. And while there is something to be said for occasional face-to-face contact, I think some companies leave a lot on the table by not implementing more comprehensive telecommuting policies.

The last thing I wanted to discuss about working from home is geographical arbitrage. Geographical arbitrage is what happens when you are not bound to a specific location for work; you can move somewhere with a really low-cost of living and slingshot your savings to the next level. Or you could cash in on some intangible value and move to a beautiful, remote European mountain village, a beach-side cabana, or maybe even a farm in South America. There are a ton of possibilities that could add a lot of value to your life. And even if you have to report to a physical work site once a week, you can still take advantage of the longer leash and a lower cost of living further out in the suburbs.

So those are some of the many benefits of working from home. If you are interested searching for telecommuting job opportunities, Flex Jobs seems to have a steady supply of job openings that could help you bump your savings rate up to the next level.

Analysis Assumptions:

- Bike every 5 years for $250

- Annual bike maintenance of $50

- Annual taxi / car rental / public transit expense of $500

- Daily car commute = 24 minutes each way (U.S. census)

- Time spent in car valued at $10 per hour

- Weekly bike riding = 2 hours at $0 per hour

- Car costs at $0.50 per mile (AAA, NY Times)

- Average mileage per year = 15,000 (AAA, NY Times)

- Savings grow at inflation-adjusted rate of 4% per year

——————————————-

Update:

The above analysis assumes you completely get rid of your vehicle and use alternatives instead. But what if you want to keep using your vehicle exactly the same way for everything outside of work. Assuming work is about 50% of your annual 15,000 miles, that means you’d still be driving 7,500 miles per year. On top of that, the cost per mile savings for when you didn’t drive would be less than normal, at 40 cents per mile, because you’d still have to pay some relatively fixed costs like insurance and a little bit of depreciation (estimating about 5 cents per mile each).

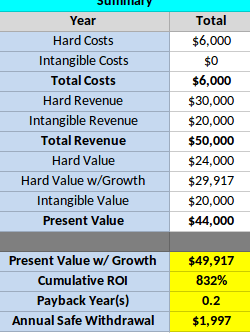

Anyway, so here are the numbers for working from home, keeping your car, and driving normally in all other ways:

- 10-Year NPV: $49,917

- 10-Year ROI: 832%

- 10-Year Payback: 0.2 years