Abstract

It’s no surprise that smaller homes cost less, but perhaps it is a surprise to learn just how much less. The short answer is that every 100 square feet of new house costs at least $10,000 in the first 10 years of homeownership while existing homes are probably closer to $7,000 per 100 square feet in the first 10 years. By this reasoning, buying 500 square feet less of a home can save $50,000 in the first decade of ownership.

Introduction

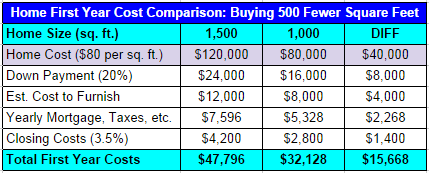

How much does the average new house cost in the U.S? The Census Bureau says it is about $80 per square foot (or $120,000 for a 1,500 square-foot home), but this misses some additional expenses, such as closing costs, opportunity costs (on average, housing isn’t the best investment), costs to furnish the house, interest costs, property taxes, etc.

According to my rough calculations, $100 per square foot is a more accurate estimate of the fully-loaded cost for new housing in the U.S., likely even more than that if interest costs and taxes are taken into account for the entire term of the mortgage, not to mention maintenance, utility, and upkeep costs, among other things (Update: ROI that includes utility expenses is available at the bottom).

So how much does a bigger house actually cost a homeowner over the course of 10 years? That is the subject of this article, and the simple answer is that each additional square foot of a new house will cost about $100 over a 10-year time-frame (versus say, $70, for existing homes). Therefore, deciding to buy a new 1,500 square-foot home will cost about $50,000 more than buying an equivalent 1,000 square-foot home, all else being equal.

The Numbers

Using the example from above, here are some other assumptions for the ROI calculation:

The estimated mortgage payment comes from Zillow’s Mortgage Calculator with a 3.8% rate on a 30-year mortgage and a 20% down payment. The 3.5% closing costs also come from Zillow. The 10% furnishing costs are really just a guess, but they largely depend on tastes and are on the low-side of many estimates I found online. As mentioned above, the per-square-foot housing prices come from the Census Bureau, and the house sizes are my own invention, albeit on the smaller side of what most new houses look like today but actually probably somewhat in line with the average size of all existing housing stock in the U.S. (I am a self-admitted fan of the idea that less is more and the Tiny House movement.)

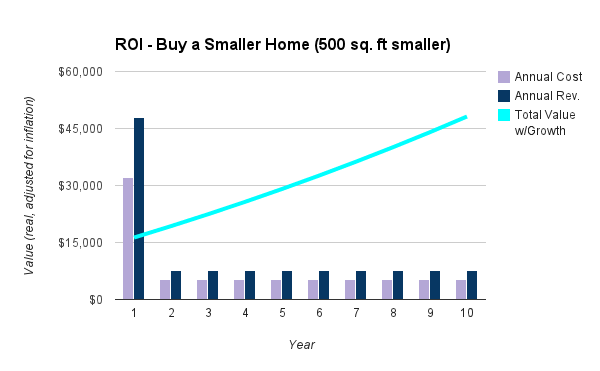

So plugging all those assumptions into the ROI model, I get the following:

It isn’t any big surprise of that smaller houses save money, but knowing just how much money they save, at least $50,000 in this case, is valuable information.

An important point to make here is that for all sizes of new homes, even 10,000 square-foot McMansions, reducing home size by 500 square feet will always save about $50,000 over 10 years, and even more after that.

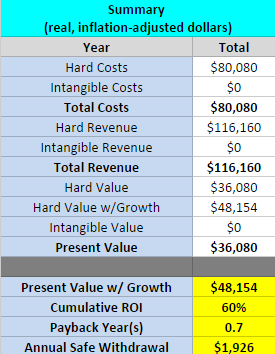

The price per square feet for used homes is hard to come by, but this Talahasse real estate article puts used homes at about 65% of new home prices on a square-footage basis in 2011, which appears to be unusually low by historical standards (at least for that market). Rounded up to 70%, this means that existing home purchasers can save about $35,000 for every 500 square feet they decide they don’t need. Still, a pretty slam dunk deals if you can afford to let go of that space and get cozy with your housemates/family.

Other Ways to Save Money on Housing

One easy way to save additional money on housing is to buy an older home rather than new construction. I plan to do an analysis on this in the future, but it is tricky because older homes might be less energy-efficient and/or might require higher ongoing maintenance expenses, although new homes apparently aren’t always without problems of their own either. According to Investopedia (and the Tallahassee article above), the average new home sells for about 30% more than the average existing home.

Another possible way of saving money on housing is to rent rather than buy. The New York Times has a good Rent vs. Buy Calculator, and I also like Jim Collins’ analysis. Even Mr. Money Mustache admits that he probably would have been better off renting rather than owning his last house (see comments about hindsight). One of the main variables to pay attention to for renting rather than owning is the expected length of residence. A short-term stay usually favors renting (less than 3 or 4 years), while a longer-term often favors buying.

A third way to save money on housing is to get roommates. I’ve written about this before, so I won’t get into it here (pretty straightforward idea). But a small variation on that idea is community housing (cohousing), which is like a sophisticated, grown-up version of dorm living, but usually with independent living structures (no shared bathrooms for example). Cohousing residents stand to save money through the pooling of shared resources and labor such as outdoor space, vehicles, playgrounds, guest rooms, tools, cooking, babysitting, etc. Not to mention that having a tight-knit community is arguably the best thing one can do for happiness.

Conclusion

If it isn’t too much of an inconvenience, buying a smaller rather than bigger house can save a whole lot of money in the first ten years, and even more over the life of a mortgage. For new homes, a rough rule of thumb is to assume $100 saved for every square foot removed from a home or $10,000 for every 100 square feet. For existing houses, the number is probably closer to $70 per square foot removed, or $7,000 per 100 square feet.

———————————————-

Update

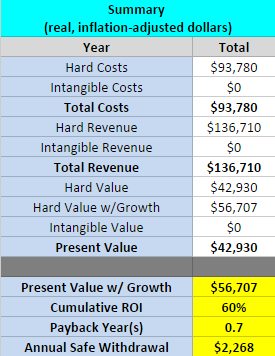

I decided to run the numbers again to include utility expenses. Assuming $1.37 per square foot in annual utility expenses, the value of buying 500 fewer square feet of house jumps to $56,707. For an existing house, it is probably somewhere in the neighborhood of $40,000 over the first ten years of ownership.