A good friend of mine loves to admonish people that “less is always more,” which is sort of funny coming from a guy who lives very large. I mean, this is a guy that used to smoke a half pack of cigarettes every day and still managed to walk on to the top college swimming team in the country. This is a guy that used to run 6 miles home from the bars on a whim. Probably the loudest most self-assured dude in the room. All that being said, however, I love the guy like a brother, and I must admit he definitely has some style. And if you look closely, you can see the “less is always more” philosophy playing out in more subtle ways.

Not that I need much convincing anyway; having/spending/doing less appeals to my pragmatic minimalist instincts more than the clutter and disorganization that inevitably comes with having/spending/doing more. If you can can accomplish the same thing with half the effort, time, or money, why do it any other way? Why do with two what you can do with one? Why buy something extra when something you already have will work just fine?

Additionally, a “less” lifestyle approach comes with a whole lot of synergy. For example, a smaller house is easier to clean, cheaper to furnish, likely easier to maintain and repair, and has lower utility costs. The same could be said with economy vs. luxury cars. They are more fuel efficient, cheaper to insure, etc. And then there is also the fact that consuming less makes people happier.

Not to get too philosophical, but doing more with less seems to be a fundamental preference of mother nature as well. Think about water flowing downhill on the path of least resistance, or elegant evolutionary adaptive traits. There is little to no waste in nature because waste is a survival disadvantage.

New-age-y Perspective

This fits in nicely with a Taoist, wu-wei approach to life. Wu-wei is a Taoist principle meaning active inaction. It deals with basically trying to be true to your real nature, not struggling or swimming against the current. Water flowing around a rock is a common example of wu-wei. You want to be like water… don’t try to fight your way past the rock, just go around. A sort of cutesy book about Taoism called the Tao of Pooh frames it this way:

Things just happen in the right way, at the right time. At least when you let them, when you work with circumstances instead of saying, ‘This isn’t supposed to be happening this way,’ and trying harder to make it happen some other way.

I like Taoism a lot, and it is easy to see to strength of principles like wu-wei. I see more and more research that reinforces this belief, things like the benefits of a barefoot lifestyle, how being exposed to more germs as a kid boosts your immunity, how vaginal births and breastfeeding make for healthier kids. We are natural beings and there is a lot to be said for staying true to our natural life cadences. Not to say there isn’t value in “unnatural” things like immunizations, just that as a general principle, nature works pretty well the way it is.

Retire earlier by spending less instead of earning more

First off, obviously do both if you can. Earn more and spend less, and that will chop a good deal of time off your working years. But for thought experiment purposes, I’m framing this as a (false) dichotomy.

The trump card that spending less has over earning more is that spending less impacts your lifetime spending needs. Earning more only works until you retire.

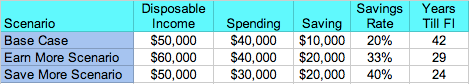

The way I set this example up is that I assumed that someone or some family has a take-home pay of $50,000 per year. This is just a nice round number to use, but the same principles work at all income levels. The base case is that this person is saving $10,000 each year, which would put their savings rate at 20% and be enough to retire from after 42 years of growth (read more here). For someone making, say, $30,000 per year, the equivalent number would be saving $6,000 per year.

42 years is a pretty long career, unless of course you love what you do. So this person, we’ll call him Chuck, decides he wants to save an additional $10,000 each year to retire quicker, for a total of $20,000 in annual savings. So Chuck is trying to figure out if he should put some of my ROI ideas into practice to save money or maybe go find a higher-paying job. Either way, he saves the same amount each year, but spending less gets him to retirement 5 years quicker.

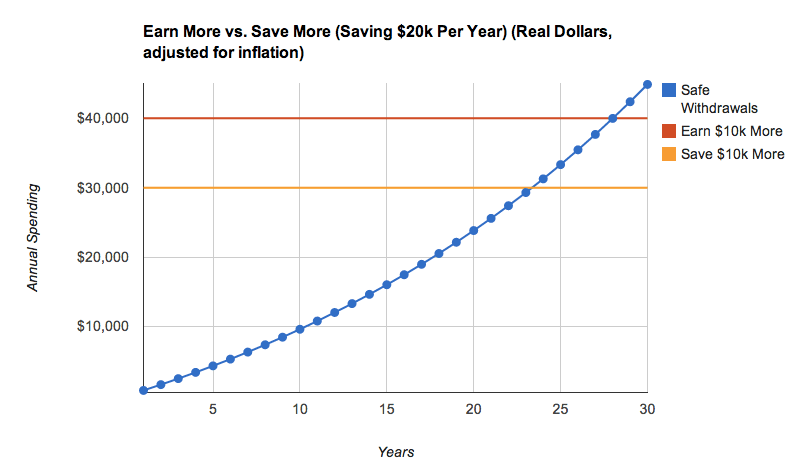

See the chart below:

As you can see, saving gets Chuck to retirement or financial independence roughly 5 years earlier than earning more. Not too shabby. On the technical side, I’ll just remind you that these are real dollars, and I’m assuming a 4% real growth rate per year in Chuck’s investments.

My wife correctly pointed out that going for a 20% to 40% savings rate is much harder for someone making a lower salary. But the concepts hold true at any income level. If you can cut a little waste out of your spending, it is a lot better than increasing your salary by that same amount. This is all just an argument for prioritizing the spending side of the equation first. It is definitely not lost on me that cutting additional spending out of a $30,000 budget is a lot harder than cutting spending on a $50,000 budget, but there is always room for improvement.

An additional benefit that I didn’t mention earlier for the less vs. more debate was that less is generally better for the environment too. The phrase “lower carbon footprint” pretty much hits the nail on the head. This article even goes so far as saying that people should be paid not to consume for the sake of the environment. Not that I agree 100%, but it does a nice job illustrating some of the environmental benefits of a downsized lifestyle.

If you don’t know, now you know. And if you want to see some people taking “less” to some pretty radical extremes, check out Cashville Skyline’s article about the Tiny Home Movement.

And if you want to see how a family of three can live a pretty nice life on $25,000 per year, granted they have no mortgage or housing costs, check out Mr. Money Mustache’s 2013 expenses.