Abstract

Living abroad in countries like Ecuador or Thailand can save the average American serious money (and serious working time). Specifically, living in an inexpensive country abroad for 10 years saves nearly $225,000 versus living in the U.S., and even more than that for big spenders. As more and more people transition to location independent careers, this is an option that deserves more than just a passing thought.

Intro

The New York Times recently reported that there are over 300,000 U.S. retirees living abroad, which is actually a pretty small number given our large population here in the U.S. (300 million). What I’m going to look at today is how much money one might be able to save by living abroad for a few years, similar to these 300,000 expat retirees.

I’ve mentioned location arbitrage before in my post about working from home, but the basic idea is to live somewhere where you can maintain pretty much the same level of income while having a lower cost of living. Location arbitrage feels like it was designed specifically for retirees, people who work from home, and freelancers, who will, by chance, account for more than 50% of the full-time U.S. workforce by 2020. But there are also other groups of people that could gain a lot of value from location arbitrage.

I’m thinking specifically of people that want to pretire, which, by my definition, amounts to earning just enough to cover living expenses while letting existing savings grow in the background (a version of front-loading). Not that savings necessarily have to decelerate, however. Some people find it easier to save abroad than they did while living in the U.S.

Take my neighbor for example. He lived in Thailand from 1990 to 2002, working as a school counselor. He made more money in Thailand than in the U.S. while also enjoying their super-low cost of living. He estimates that he was able to live off of roughly $8,000 per year there, which enabled him to save enough money to come back to Portland and retire. So he actually experienced the best of both worlds: lower cost of living + higher income. Apparently it doesn’t always have to be a trade-off, even for the non-freelance crowd.

There is also a case to be made for spending the first few years of retirement abroad in a cheaper country. Why? The first few years of retirement withdrawals are really important for helping the nest egg last a long time. If the the first few years of withdrawals are too aggressive then rates of failure (not having enough money to last through retirement) increase. If, on the other hand, the first few years of withdrawals are cautious and more conservative, rates of failure should decrease as this allows the portfolio a little more time to grow.

The big downside of permanently retiring abroad, for me at least, is the prospect of being far away from family and friends. Of course the expat retiree community is probably pretty fun, but I don’t think I could fully abandon my roots. However, I can surely empathize with people who might make that decision…. it could cut years off of a career.

For example, retiring abroad in, say, Chiang Mai, Thailand would require about $500,000 of savings for someone that normally spends $30-$40k per year in the U.S. While retiring here in the states would require twice as much money, or about $1,000,000 in savings. In terms of a working career, for a couple maxing out their 401k and IRA, retiring abroad instead of at home would save them each 6 years of work (8.5 years instead of 14.5 years). For an individual, it would be closer to 9 years of work saved (14.5 years instead of 23.5 years). We’re talking about an additional 6 – 10% of a person’s life spent retired rather than working.

The numbers

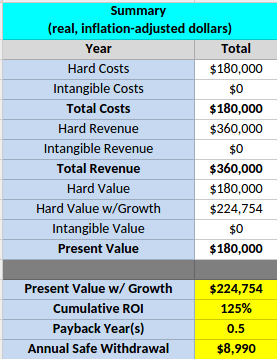

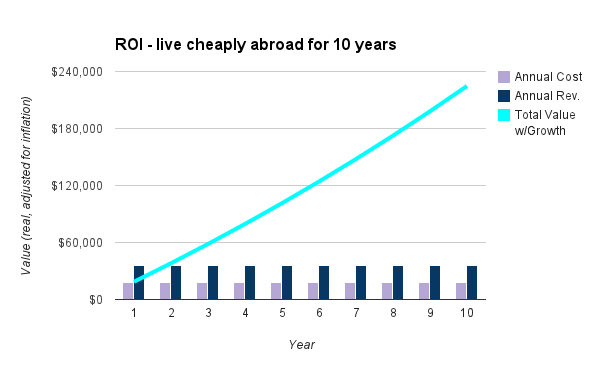

For this example, I’m comparing living on $36,000 per year in the U.S. to living on $18,000 per year abroad ($3,000 per month vs. $1,500 per month). Over the course of ten years, here’s the breakdown:

- 10-Year NPV: $224,754

- 10-Year ROI: 125%

- 10-Year Payback: 0.5 years

Wow… this might be the biggest NPV of all the ROI analyses so far, about $225,000 per decade simply by going on an extended vacation 😉. Another interesting way to look at it, from the pretiree or early retiree perspective is that each year abroad is equal to about a $900 increase in annual safe withdrawals going forward, not to mention the growth happening in the background on an already existing retirement portfolio.

Conclusion

Living abroad can really make a wallet smile and cut years off a career. Almost anybody can leverage a little location arbitrage in their life at some point, just make sure to avoid the fancy pants countries (they’re more like the U.S. and probably comparatively less exciting anyway).

For a list of some of the cheapest places to live abroad, I found International Living’s website pretty helpful. Their top picks are Nicaragua, Malaysia, Equador, Panama, and Mexico, but I’ve heard of many other sweet (and inexpensive) destinations that work well too, such as Thailand or Nepal. The advantage of Mexico or another Central American country is that it could be much closer to family and friends at home. Perhaps there is some sort of hybrid snowbird arrangement to be had there.

Either way, location arbitrage seems to make a whole lot of sense and from a variety of perspectives (money, life experience, food, weather), which is why this will very likely be a part of the FG ROI plan going forward.