Previously, I showed how low-cost, passive mutual funds can save you money versus actively managed funds that try to beat the market. And in this post, I am here to tell you that ETFs can accomplish the same thing, and maybe even do it better.

Giving credit where credit is due, this article wouldn’t have happened if I didn’t come across Green Stream Money’s post about the difference between ETFs and mutual funds. Granted, I was already aware of a few differences, but I wasn’t aware that for a lot of people, ETFs can be even cheaper than low-cost mutual funds.

As info, both ETFs and mutual funds are simply bundles of publicly traded securities, such as stocks and bonds. So instead of buying a bunch of individual stocks and bonds, you can just buy a group of them that someone else has already picked out. And clarifying the distinction between active and passive funds, active funds generally try to beat the overall market by hand-picking certain securities they think will grow quicker, while passive funds simply seek to approximate overall market returns, which is a lot easier to do.

So ETF stands for exchange-traded-fund. ETFs accomplish largely the same thing as mutual funds, but there are a few key differences:

- ETFs can be much cheaper than mutual funds. An active mutual fund might have an expense ratio of 1.0%, while a passive mutual fund might have a ratio of 0.2%. But neither of these comes close to the deal you get with some passive ETFs, which can be as low as 0.04% (about 1/5 as expensive as a typical Vanguard index mutual fund).

- You need less money to start investing in ETFs. The minimum initial investment for a mutual fund might be $2,000, but a share of the same ETF could be purchased for only $20.

- You are more likely to be charged a brokerage commission for ETF purchases. This isn’t always the case, especially when you are buying from and using the same brokerage. For example, Vanguard doesn’t charge a commission if you are buying their ETFs.

- ETFs can be traded immediately. You can buy or sell an ETF immediately, at the current market value any time during the day. Mutual funds, on the other hand, are bought and sold at the end of the day.

- ETFs are subject to a bid-ask price spread. A bid-ask price spread is simply the difference between what sellers in the market are willing to sell their shares for and what buyers in the market are willing to buy for (think flea market haggling). Mutual funds, on the other hand, are legally required to buy and sell at the fair net asset value (NAV), which eliminates the bid-ask price spread.

As you can see, there are advantages and disadvantages to both kinds of funds. My personal opinion is that ETFs are probably a better option for the average investor because they are cheaper, more flexible, and easier to get into. Some people might argue that the bid-ask price spread and brokerage commissions can eat into your returns and also that mutual funds can have equally low expense ratios. These are valid points.

Addressing the expense ratio argument, using Vanguard as an example, you need to invest over $10,000 in mutual funds to get a lower expense ratio that would already be available to the ETF investor with $20. Assuming a $10,000 initial investment isn’t an issue for you, it is still only an argument for equivalence, not an argument in favor of mutual funds.

Addressing bid-ask price spreads and brokerage commissions, I would say that brokerage commissions are easily avoidable; just trade and buy from the same place. As for the bid-ask price spread, they are generally pretty small for common ETFs that a wise passive investor would be purchasing. Secondly, the bid-ask price spread matters less and less in the long-run because it is a one-time expense. There is also a decent chance that you will recover a good chunk of the spread when you sell your ETFs.

Those were the words, here are the numbers. As a reminder, this scenario assumes that you start with no existing savings but start maxing out your 401k and IRA accounts for a total of $23,000 invested each year. Also, I’m assuming an expense ratio of 0.086% for the ETF portfolio (the weighted average cost of my existing ETF portfolio) and 1.000% for the actively managed mutual fund.

- 10-Year NPV: $15,284

- 10-Year ROI: 1,243%

- 10-Year Payback: 0.1 years

So going with a cheap ETF portfolio (0.086% expense ratio) versus an actively managed mutual fund (1.000% expense ratio) saves you about $15,000 over ten years. This is worth about $600 of retirement income per year for the rest of your life, or $50 per month to infinity and beyond.

Comparing this to last week’s example of a low-cost passive mutual fund (0.20% expense ratio) versus an actively managed mutual fund, you can see that the ETF portfolio saves you about $1,900 more over ten years than the low-cost mutual fund.

As I have mentioned before, these savings just continue to grow as your retirement stash grows. By the time you have enough saved for retirement, you will probably have at least $500,000 in your investment accounts, and that is where those little decimal places really start to make a big difference.

Hopefully this has convinced you to start investing in ETFs. But maybe you don’t know where to start. Here is how I would do it:

1. Open up an investment account with a brokerage (my personal preference is Vanguard). Make sure you designate the account as an IRA or Roth IRA if you are saving for retirement (differences explained here).

2. Deposit money into your brokerage account in the Prime Money Market Fund (max yearly contributions are $5,500 for IRAs as of 2014).

3. Buy some ETFs with your Prime Money Market Fund.

Okay, but which ETFs should I buy? Using Vanguard as an example, you are going to want to buy some combination of the following ETFs:

- Total Stock Market ETF (VTI) – this is your exposure to U.S. stocks

- Total International Stock Market ETF (VXUS) – this is your exposure to international stocks

- Total Bond Market ETF (BND) – this is you exposure to U.S. bonds

- Total International Bond Market (BNDX) – this is your exposure to international bonds

- REIT ETF (VNQ) – this is your exposure to alternative investments, specifically real estate

I don’t want to get into a detailed discussion of allocation between these five kinds of investments because it is sort of complicated and deserving of its own post at some point (maybe). But I will just set out the basic framework, which is that stocks have the highest potential for growth, but are also the riskiest. Bonds are less risky but also don’t have as much potential for growth. And adding alternative investments and international stocks and bonds helps reduce your risk, a concept called diversification.

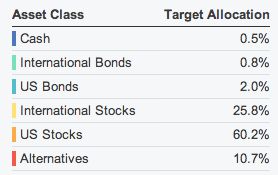

If you are new to all these concepts, I highly recommend using Personal Capital’s free investment checkup tool to determine your optimal ETF allocation (use the tool after step 2 above). Each situation is different because of risk preferences, goals, and timelines. As an example, here is the asset allocation I have right now thanks to Personal Capital:

So that’s it. Invest your $5,500 according to your personalized allocation (or simply dump it all in the total stock market ETF if you want a really simple but higher-risk option). You will probably want to rebalance maybe once a year or so to make sure your allocation doesn’t get too out of whack, but again, Personal Capital makes that really simple to do as well.

Doing this can save you beaucoup dinero over the course of a lifetime just in investment fees. And don’t forget about rolling over old 401k’s and IRAs as well. You don’t want to be leaving money on the table there either.

For more scoop on ETFs vs mutual funds, check out Vanguard and Bogleheads.

Assumptions:

- Inflation-adjusted growth of 4% per year

- Industry average fund expense ratio = 1% (Vanguard)

- Vanguard average fund expense ratio = 0.2% (Vanguard)

- ETF weighted average expense ration = 0.086% (Self)

- Max out your 401k and IRA for total annual investment of $23,000

- No employer match factored in

- No prior investment balance