Before we get too far ahead of ourselves, let’s talk about some of the core concepts of early retirement and financial independence (FIRE). First, a loose definition:

- Financial independence – you no longer need an active income because you have enough passive income to sustainably provide for yourself through the future.

- Early retirement – you are financially independent (no longer need to work), and you decided to pursue a new kind of life in the wake of said financial independence.

Okay, sounds great, but is the view worth the climb? I was skeptical when I first heard about early retirement… Don’t the sacrifices required to retire early outweigh the benefits? After thinking about it, doing some research, and trying the shoe on for size, I can emphatically say, NO! My life is much better now and continues to improve as we make progress towards our goals. We trimmed a lot of waste from our life, getting rid of distractions, and focusing on sustainable sources of happiness.

Benefits of Financial Independence

The benefits of financial independence and early retirement depend partially on what kind of lifestyle you plan to lead, but I believe the following to be common to most any situation:

- Happier and healthier – people generally use the extra time to exercise more, eat better (more time to prepare your own food), and most importantly, socialize with family and friends (this is often cited as the key to happiness). If you also happen to be lucky enough to retire before you have your children, your kids will be more likely to be happy, healthy, intelligent, and successful thanks to the extra time you can spend with them. (Source: What’s the Economy For, Anyway?: Why It’s Time to Stop Chasing Growth and Start Pursuing Happiness)

- Financial freedom – let’s talk about that large pile of cash, or as some like to call it, your F.U. money. What this means is that it just got a lot harder for the “man” to hold you down. Think along the lines of more equitable relationships at work, quitting your job completely, less expensive or non-existent life insurance, freedom to pursue what were once riskier business ventures and/or promotions, etc.

- Free time – At a minimum, as mentioned above, you will become happier and healthier as a result of extra free time. Personally, I also plan to pursue other dreams, hobbies, and life goals such as being an involved parent, traveling more, connecting with nature on a daily basis, starting a high-impact non-profit, eating better, learning new skills, exercising, building community, etc. What would you pursue with double the free time that you have now?

Alright, so this all sounds great, but how do you get there? The very simple answer is: save more money, the sooner the better.

Saving and Early Retirement

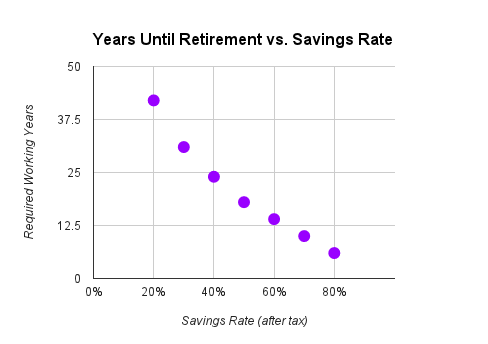

A strong savings rate is the central tenet of early retirement. For example, a 20% savings rate means you need to work for roughly 42 years, 40% for 24 years, 60% for 14 years, and 80% for 6 years. Take a look at the chart below, which is calculated with a 4% inflation-adjusted rate of return assumption (a pretty conservative long-term growth rate for investments).

As you can see, the largest gains are found moving from the very low savings rates due to longer compounding interest periods. This should be especially encouraging to new FIRE enthusiasts because it shows that even a small increase in savings rates nets a large decrease in years until retirement. This model is built on the assumption that your current consumption levels will not increase in retirement, so sacrificing by living in a tent and saving 90% for 2 years, only to retire into a middle class suburb lifestyle will not work. However, there are major gains to be had by saving more earlier in your career.

Increasing your savings rate is the single most important thing you can do on the road to early retirement, and there are only two ways to do that: 1. spend less and/or 2. earn more. Flannel Guy ROI focuses on the spending side of the equation because that is where you have the most direct control and often where there is more opportunity for improvement.

Few Other Key Principles

Besides having a strong savings rate, there are a few other key principles to keep in mind:

- You can retire when you have 25x your annual spending in savings. This rule of thumb is based on historical stock market returns. See this calculator for probability forecasts of successful retirement based on your individual situation.

- You can safely withdraw 4% of your stock portfolio over the long run. This is based on historical stock market returns. And if you retire early, you can probably choose to go back to work rather than withdraw during an economic downturn (if you want to play it really safe).

- The earlier you save, the better. Compounding interest means that a dollar saved today is worth $2 in 18 years, $3 in 28 years, and $4 in 35 years (4% inflation-adjusted compounding growth). The corollary of this is that delaying retirement by just a year or two can significantly boost the value of your portfolio. However, someone sprinting too early retirement in 6 years by saving 80% of their income won’t be able to take advantage of very many years of compounding interest, so the primary focus should be on saving alone instead of investment growth.

- The average American could spend a lot less money without sacrificing much happiness. For example, simply buying a used versus a new car or cooking for yourself more often can have a big impact on your savings rate without sacrificing real happiness (sometimes you might even get a net happiness boost). The average American wastes a lot of money; try to be above average.

- Exceptional saving is more powerful than exceptional investing. If the average American is saving 5% (not too far off the mark recently) and you are saving 30%, that makes you 6 times more effective than the average American. On the investment side, if the average person is earning 7% long-term on their stock investments and experts like Carl Icahn are earning 17%, the very unlikely possibility of playing the stock market like an expert would only earn you a little over 2x the average American (it would eventually be an advantage, but only if you could keep it up for 20 years). Additionally, saving $1,000 extra dollars per year will get you to retirement quicker than earning an extra $1,000 per year because saving the money will increase your savings rate more. For example, you make $50k and save 50% or $25,000 dollars. If you reduce you spending by $1,000, your savings rate jumps to 52%, versus earning $1,000 more and keeping your spending constant, which only increases your savings rate to 51%.

Conclusion

Together, these are some of the main concepts of early retirement and financial independence. I have tried to show that financial independence is a way to get out of the rat race earlier than normal and seems like it could be loads of fun. Furthermore, how soon you achieve financial independence depends almost entirely on your savings rate; with a higher rate getting you there sooner. And finally, saving more earlier is better than saving more later because of compounding interest, and saving more, in general, is easier and more powerful than making more money and can be done in a way that doesn’t sacrifice happiness.

That concludes my brief into. If you have never come across this kind of information before and want to learn more, I very much recommend checking out Mr. Money Mustache. He really goes deep into the theory, concepts, and attitudes of the whole thing and is fun to read. I probably won’t go much deeper than this on occasion, as my focus is more on practical everyday decision making, but I will vouch for 100% for MMM. He has a loyal following for a reason.

Hopefully, you have a little more context now for what I am trying to accomplish with the ROI experiments and spending optimization in general at Flannel Guy ROI. Stay tuned for more actionable ROI’s.

Cheers – FG ROI

Addendum

I should also point out that there is another school of thought regarding early retirement and financial independence. We’ll call these guys the cash-flow crew. The idea is the same, you still want to have enough passive income, or cash-flow, to cover your living expenses indefinitely. The difference is that the cash-flow crew isn’t as concerned with a net worth or safe withdrawal rates. They advocate simply adding high-cash-flow assets, like rental properties, to your portfolio until your passive income exceeds your expenses.

FI Fighter is a good example. He is generating an impressive cash flow off of some more modest real-estate investments. He is able to do this because of the highly leveraged structure of real-estate finance. There are certain risks involved in leverage, but a risk-tolerant person could definitely retire earlier with this strategy if things went according to plan. Some of the other members of the cash-flow crew build automated websites and write ebooks in an attempt to secure that passive income quicker.

These are all viable options to keep in mind if you want to retire early or just gain financial independence sooner than most. The basic idea isn’t any different. Simply find a way to generate enough passive income to cover your living expenses indefinitely, and you are set.