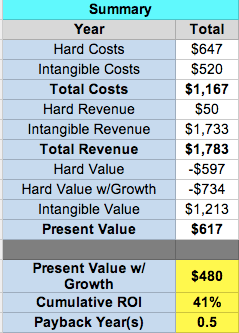

How much money could you save by working from home, or to put it differently, how much of a pay cut would you be willing to take to work from home? Answer: $106,000 over 10 years, over 2 times the average American salary. Unfortunately, quality work-from-home opportunities are not always easy to come by.

If you are lucky enough to work for a company with an established telecommuting policy and you don’t already work from home, you may want to reconsider. Working from home isn’t for everyone, but for the early retirement / financial independence enthusiast, it can be a very powerful lever to increase your savings. There are also other fringe benefits such as more comfortable work attire, possible tax deductions, lower clothing expenses, better time utilization, geographical arbitrage, etc.